ADVERTISEMENT

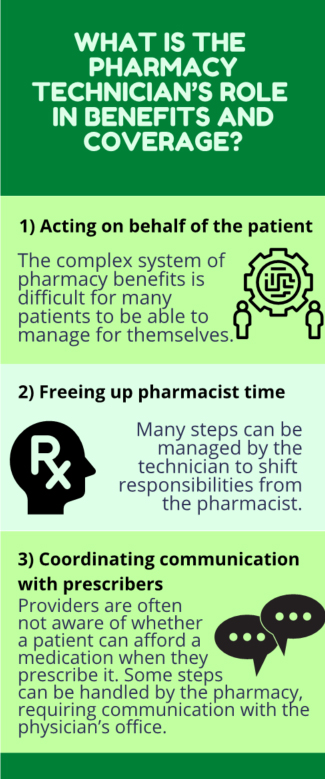

Through medication therapy management (MTM), pharmacists help optimize drug therapy and improve therapeutic outcomes. An initial step is to determine what medications a patient is actually taking, which medications are providing the desired therapeutic effect, and whether any medications might be discontinued. After a complete and accurate Personal Medication List (PML) is developed, it’s time to determine what the patient’s drug benefits will cover and whether the patient can receive assistance with costs that are not covered. The pharmacy technician's roles in helping patients with benefits and coverage are summarized in Figure 1.

Figure 1. Pharmacy Technician's Role in Benefits and Coverage

If a patient is unable to refill a needed medication because of high out–of–pocket costs, this defeats the purpose of MTM. Navigating the drug benefit system can be daunting. However, by tapping the right sources of information and adopting standard procedures to guide the process, pharmacy technicians can fulfill an essential aspect of MTM. Each practice site will need to determine the extent of services that pharmacy technicians are able to provide based on demand, workload, and resources. A checklist and flowchart to aid in organizing information about patients’ benefits is provided Table 1.1

| Table 1. Medication Benefits Checklist1 |

| General |

Government Programs |

|

□ Name

□ Address

□ Phone Number

□ Date of Birth

□ Social Security Number

□ Total Household Income

□ Household Size

□ Current physician: PCP or specialist

|

□ Medicaid (equivalent state program )

□ Medicare

□ Medicare Low-income subsidy

• Income, Asset

• Disabled? (need 2 yrs)

□ Qualified Medicare Beneficiary

□ Specified Low-income Medicare (SLMB)

|

| Insurance |

Patient Assistance Programs (PAP) |

|

□ No insurance

□ Insurance plan:

□ Medicaid (share of cost?)

□ Medicare:

• Name of plan

• MA-PD or PDP?

• Policy number

• Medicare card (date of eligibility)

□ Commercial plan

• Name of plan

• Policy number

|

Check program requirements for necessary documentation:

□ Income

□ Rx

□ Prescription receipts

□ Hardship letter

□ LIS denial letter

□ Explanation of benefits

• Drug coverage based on income, available insurance, Medicare Part D may disqualify patients from PAP

|

| Medication List |

Retailers Offering Generic Discount Programs |

|

□ Reconcile medication list (include OTC)

□ List indications for all medications

□ Determine if medications are covered under insurance formulary, Medicare Part B, or Medicare Part D

□ Identify generic medications

□ Identify high-cost medications

□ Determine if medications require prior authorization

□ Discuss possible alternatives to high-cost medications with pharmacist and assess coverage

|

□ CVS

□ Kroger

□ Rite Aid

□ Costco

□ Walgreens

□ Walmart

|

| Labs/Physical Assessment |

Co-Pay Assistance |

|

□ Monitoring required?

□ Collect lab results for pharmacist if available

|

Check program requirements for necessary documentation

|

LIS=low-income subsidy; OTC=over the counter; MA-PD=Medicare Part D; PDP=Medicare Prescription Drug Plans; PAP=Patient Assistance Programs.

Source: Stebbins MR, et al. The PRICE clinic for low–income elderly: a managed care model for implementing pharmacist–directed services. J Manag Care Pharm. 2005;11(4):333–341.1 |

GATHERING BASIC INFORMATION ABOUT THE PATIENT’S COVERAGE

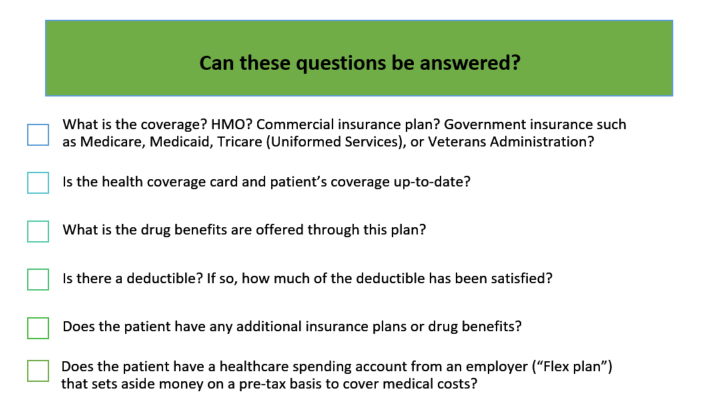

The first step in addressing drug benefit questions usually begins with asking the patient to provide his or her benefit membership or identification (ID) card. From this, the technician should be able to address all or most of the questions listed below:

COMMERCIAL PLANS

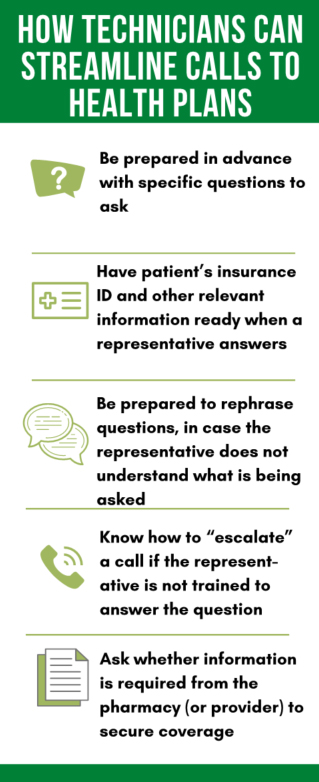

Commercial plans will allow the pharmacy, as a provider, to access information online or via phone about the patient’s specific drug coverage benefits. Getting patient–specific answers sometimes involves a telephone call, which can be a time–intensive process (with time waiting on hold or being transferred to other departments). Because of the time involved, the job of calling health plans for information often falls to the pharmacy technician. Some ways that technicians can help streamline the process are shown in Figure 2.

One of the important benefit details to understand about many drug coverage plans, including commercial plans, is the use of “tiers,” or priority levels for drugs. What tier a drug falls into will determine how much of the cost is covered by the plan and how much the patient must take on as a copayment. An example of a four–tier system from a commercial plan is shown in Table 2.

Many plans are now assigning two tiers for generic drugs—a preferred and a nonpreferred tier. Patients and providers may be surprised to learn that some generic medications therefore have a lower copayment than others.

Some organizations have formularies with five tiers, which break down specialty drugs according to less–expensive and more–expensive categories. Each insurance company determines where a given medication falls within its formulary tiers, and this dictates the amount a patient must pay out–of–pocket. Through MTM, a pharmacist or technician may look for ways to recommend drugs that fall into more favorable tiers, which benefits both the patient and the payer.

| Table 2. Example of Commercial Drug Plan 4–Tier System |

Tier 1: Generic Drugs (Lowest copayment)

• Generic drugs |

Tier 2: Preferred Branded Drugs (Second-lowest copayment)

• Preferred brand–name products based on safety, efficacy, and cost |

Tier 3: Non-Preferred Brand Name Drugs and Preferred Specialty Drugs

(Second-highest copayment)

- Brand–name drugs for which alternatives are available in Tier 1 or Tier 2; or

- Not used typically as a first line of treatment; or

- Preferred specialty brand–name drugs

|

Tier 4: Specialty Drugs

(Highest copayment)

- Medications classified (by the plan) as requiring special dosing or administration, are typically prescribed by a specialist and are more expensive than most medications

|

Mail–Order Pharmacy Benefits

Patients can often receive a larger supply of a chronic medication through their health insurance provider’s mail order service. This may include a 90–day supply of medication for a lower copayment. Some Medicare plans offer a 90–day supply of certain generic medication with no copayment required.

government-based PROGRAMS

Medicaid (and State-specific plans such as Medi-Cal in California)

Medicaid is a joint Federal–State program that pays for medical assistance for individuals and families who have a low income and relatively few assets. Although pharmacy coverage is an optional benefit under federal Medicaid law, all states currently provide coverage for outpatient prescription drugs to all eligible individuals and most other enrollees within their state Medicaid programs.2

Some Medicaid programs (such as Medi-Cal) require a share of cost (SOC) or spend-down if the patient’s income or assets are considered to be too high to qualify for full coverage.3

Medicare

Medicare provides health insurance for Americans aged 65 and older who have worked and paid into the system. It also provides health insurance to younger people with certain disabilities (such as multiple sclerosis) who have applied and qualify to receive this benefit. Part A covers inpatient hospital stays, stays in skilled nursing facilities, and hospice care. Medicare Part B covers mainly outpatient medical services, including some medications administered in a physician’s office or infusion center. Part B coverage begins once a patient meets his or her deductible (an income-based deductible amount which changes annually. This was $198 per year in 2020).2 After that, Medicare Part B covers 80% of approved services and requires the patient to pay the remaining 20%, either directly or indirectly through private Medigap insurance.2

Drug coverage benefits for patients on Medicare are provided through Medicare Part D. Outpatient prescription drug coverage for Medicare beneficiaries is fulfilled through private insurers. This coverage is available as either a stand–alone prescription drug plan (PDP), or an integrated managed care (Medicare Advantage) plan, most of which provide both medical and prescription drug coverage (MA–PD). No part of Medicare pays for all of a person’s covered medical costs. The program contains premiums, deductibles and coinsurance, which the covered individual must pay out-of-pocket. (See Table 3, Glossary of Terms.)

| Table 3. Glossary of Terms |

| Medicaid Share of cost (SOC) |

Similar to a deductible: the amount of medical expenses an individual or family must pay before Medicaid benefits kick in. This share of cost must be met monthly (not accrued over time). |

Medicare Low-Income Subsidy

(Extra-Help Program) |

Government program providing assistance to help patients pay Part D monthly premiums, deductible, coinsurance, and copayments. |

| Medicare Advantage Plan |

Medicare program that combines Medicare drug coverage and a comprehensive health plan. Covers all Medicare services except hospice care. Not all Advantage plans include Part D. Some require purchase of a separate Part D plan.4 |

| Medicare Supplement Insurance (Medigap) |

Supplemental insurance sold by private companies to cover some healthcare costs not covered by Medicare. Patient must have Medicare Part A and Part B. |

| Medicare Part D "Donut Hole" |

Coverage gap after patient has reached maximum annual Medicare Part D drug benefit. |

| Patient Assistance Programs (PAPs) |

Programs administered by drug manufacturers to provide medications or copayment assistance to individuals. (Applicants must usually provide proof of income to qualify for this benefit.) |

| Qualified Disabled and Working Individuals (QDWI) |

A Medicare savings program that allows people with disabilities to receive Medicare benefits; and allows low-income people to receive Medicare benefits and continue working. |

| Qualified Medicare Beneficiary (QMB) |

Program allowing those who are eligible to enroll in Medicare Part A to receive help with Medicare costs. |

| Specified Low-Income Medicare Beneficiary (SLMB); SLMB-QI |

Program that allows patients who do not fully qualify for Medicaid to pay partial or full premiums to receive care under the Medicare program. |

| Source: www.Medicare.gov5 |

| What is the Medicare Part D "Donut Hole" or Coverage Limit? |

|

People who receive Medicare Part D may reach a coverage limit, when their drug coverage changes or temporarily stops. This coverage "gap" begins when the patient and prescription plan have spent a combined amount set annually by CMS. For 2021, this amount will be $4,130. After this point the patient must then pay up to 40% of the cost of their branded medications and up to 35% of the cost of generics, until they fulfill the amount of spending required ($6,550 for 2021). When that figure is reached, the patient is in the catastrophic coverage level and receives a discount of 75% for brand name and generic drugs.

By using the Medicare PlanFinder tool (www.medicare.gov), pharmacy technicians may help patients estimate if they will enter the coverage gap, and which month this would start to affect them.3 Pharmacy technicians may receive training in how to compare Part D benefits offered by different plans, after a personal medication list (PML) has been established by the pharmacist. This will allow patients to verify coverage for their medications and plan financially for medication needs in the upcoming year.

|

Medicare Low–Income Subsidy

People with low incomes and assets who receive Medicare Part D benefits can apply for the low–income subsidy (LIS), also called the Extra Help program. This program provides assistance to help patients pay for their Part D monthly premium, annual deductible, coinsurance, and drug copayments. (People enrolled in the Extra Help program do not have the “donut hole” gap in prescription drug coverage. See BOX.)

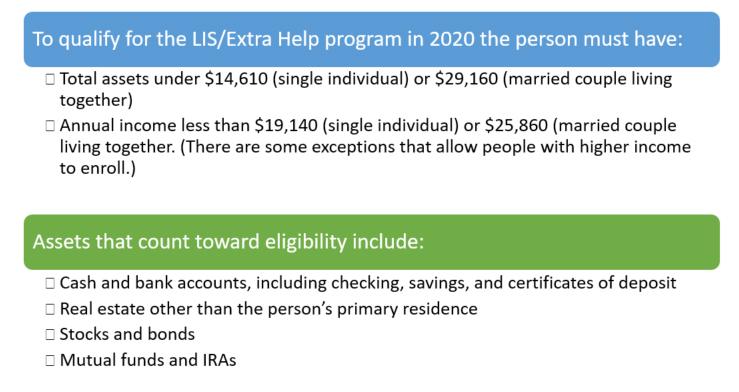

Qualifications for the LIS/Extra Help program in 2020 are summarized below.

Medicare does not count resources such as the home (primary residence), insurance policies, or a car. Many people who qualify for Medicare Extra Help do not realize the program is available. Applications can be submitted online at: https://www.ssa.gov/medicare/prescriptionhelp/. Pharmacy technicians can screen patients for eligibility and refer them to the Social Security website or local Social Security office to apply for Extra Help.

UNINSURED PATIENTS

If a patient has no health insurance or drug coverage, there are many programs that offer options to assist with or fully cover the cost of drugs.

Patient Assistance Programs (PAPs)

These programs (also called Pharmaceutical Assistance Programs) are services administered by drug manufacturers to help cover drug costs for patients with financial needs. Patients (or a caregiver or other representative) can review requirements for a particular medication on the manufacturer’s PAP website. Application forms may be downloaded or for some programs, completed online. If accepted, the PAP benefits usually last from 6 months to a year before expiring, and then patients are required to re–enroll. On the application, patients may need to provide:

- Income

- Name of drug they are requesting

- Receipts for prescriptions

- A letter describing financial hardship

- LIS denial letter (indicating the person did not qualify for Medicare LIS)

- Whether the person is uninsured, has private insurance, or government–sponsored insurance.

- A photocopy of their insurance card

A written prescription and/or a provider’s signature is generally needed on the application.

The benefits offered by these programs differ, depending upon what type of coverage the person already has. Typically, uninsured patients who qualify can receive a free supply of medication for a period of time (e.g., one year). Those with private insurance may qualify for co–pay assistance (especially for high–cost specialty drugs) depending upon income and assets. Having Medicare Part D benefits may disqualify a person from receiving PAP help, or some PAPs will provide coverage once the patient’s insurance benefit is in the coverage gap only.

Low–cost Generic Options

Some large retail pharmacy chains offer generic drug discount programs for certain common, low–cost medications. If the patient can obtain a one–month supply of a prescription for $4, it is often more economical than submitting for insurance benefit coverage for that drug. Some programs require an application and/or a membership fee, but most are relatively simple to join. Smartphone apps or websites such as Goodrx.com are one way to find the lowest cost for specific drugs. Pharmacy chains with discount generic programs include:

- CVS

- Kroger

- Walgreens

- Rite Aid

- Walmart

- Costco

In addition, the patient can contact a discount non–profit mail order pharmacy such as RxOutreach (www.RXOutreach.org).

Other Financial Assistance Organizations

Many government and independent charitable organizations offer programs that help patients with drug co–pays, medical equipment, home health care, transportation, and other needs. Table 4 and Table 5 provide contact information for some of these organizations.

| Table 4. Financial Assistance Organizations |

| Organization |

About |

Contact Information |

Chronic Disease Fund

(Also known as Good Days from CDF®) |

This organization provides copay assistance for patients with chronic diseases who meet eligibility requirements. (New enrollment for some disease states closes temporarily when funds are diminished.) |

Email: info@mygooddays.org

Phone: 877-968-7233 |

| Healthwell Foundation |

A nonprofit organization that offers copay, coinsurance, and premium assistance. |

Email: grants@healthwellfoundation.org

www.healthwellfoundation.org/

Phone: 800-675-8416 |

| Disease-specific organizations |

Many chronic disease states (multiple sclerosis, Parkinson's, COPD, Alzheimer's disease, etc.) have advocacy organizations that offer assistance with drug co-pays, home help, and other medical services. |

Look for disease-specific organizations such as:

MS: www.nationalmssociety.org

PD: www.pdf.org

AD: www.alz.org

COPD: www.copdfoundation.org |

| Patient Advocate Foundation Co-Pay Relief Program |

Direct copay and coinsurance for insured patients (including Medicare Part D) whose income is below 400% of Federal Poverty Guideline (household expenses are considered). Patients must be insured with coverage for medication for which the patient seeks assistance. |

www.copays.org

866-512-3861 |

| Patient Access Network Foundation |

Copayment assistance from $500 to $15,000 per year depending on diagnosis. Patient must be insured with coverage for medication, and meet financial criteria. |

www.PANfoundation.org

866-316-7263 |

There are a few organizations that serve as “clearinghouses” to help patients search for help from multiple sites at once. These are shown in Table 5.

| Table 5. Directory Services to Find Financial Assistance |

| NeedyMeds.org |

Nonprofit organization provides a directory of pharmaceutical-company sponsored patient assistance programs (PAPs), coupons and rebates, as well as Drug Discount Cards. Subscriptions are available at no charge. |

www.Needymeds.org

Helpline: 800-503-6897 |

| RxAssist |

This site contains a current and comprehensive directory of pharmaceutical company-sponsored PAPs. Also provides Drug Discount Cards for medications, some with moderate enrollment fees. |

www.Rxassist.org

email: info@Rxassist.org |

CONCLUSION

Pharmacy technicians need to know a lot about medication payment systems. However, in everyday practice, the technician may not be in a position to help patients look for alternative payment options. In MTM, this service should be provided to ensure the patient is receiving all of his/her recommended medications, takes them as prescribed, and refills the prescriptions appropriately. Patients are often unaware of the options available to help them manage high monthly medication bills. Technicians are frequently assigned to help explore payment options and clarify coverage information, especially if the investigative “digging” requires time–consuming telephone calls to insurers or other payers.

REFERENCES

- Stebbins MR, Kaufman DJ, Lipton HL. The PRICE clinic for low-income elderly: a managed care model for implementing pharmacist-directed services. J Manag Care Pharm. 2005;11(4):333-341.

- Medicare.gov. Medicare costs at a glance. 2020. Available at: https://www.medicare.gov/your-medicare-costs/medicare-costs-at-a-glance.

- Medicare.gov. Find a 2021 Medicare plan. Available at: https://www.medicare.gov/plan-compare/#/?lang=en&year=2021.